<Exploring the Absurdity of NFTs: A Critical Perspective>

Written on

NFTs have generated considerable discussion over the last six months. One might assume that tech enthusiasts now comprehend what NFTs are, their potential applications, and the technology underpinning them. However, there remains a significant gap in understanding, particularly regarding their perceived value and rationale.

It seems that tech journalists are hesitant to outright reject such a trending topic, especially with influential figures like Jack Dorsey and Michael Jordan amplifying the excitement. Consequently, lengthy articles often obscure clear explanations, leaving readers confused.

As a technology consultant, I aim to clarify complex ideas concisely. Let’s dive into why NFTs are fundamentally flawed without excessive elaboration.

A Brief Overview

If you’re unfamiliar with a Non-Fungible Token, here's a quick definition: it acts as a unique identifier (or token) representing ownership of a digital asset. Unlike currencies such as the dollar, which can be divided or replicated, NFTs are "non-fungible," meaning they cannot be split or duplicated. Ownership records are maintained on a global network of computers (the blockchain) to prevent fraudulent claims. To ensure each token's uniqueness, computers on the blockchain solve complex mathematical problems, but that’s the crux of it.

1. Illusory Scarcity

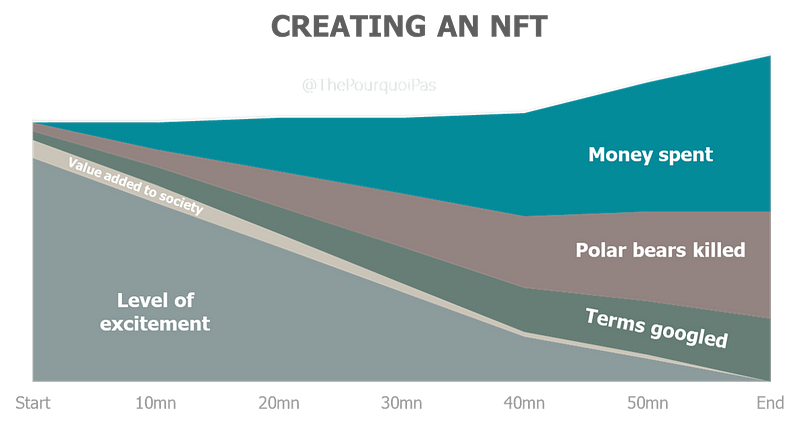

Several months ago, I created a graph that I subsequently turned into an NFT, asserting my ownership as verified by the blockchain. However, this does not prevent others from viewing, copying, or sharing the image for free. While I might argue that the NFT's uniqueness enhances its value, this perception does not hold up against the reality of digital reproduction. Additionally, anyone could create their own NFT of the same image through simple copying. So, what’s the incentive to purchase it?

One might suggest that owning such an asset could yield benefits like copyrighting, selling, or altering the content. But here’s the issue...

2. Copyrights Remain with Creators

An NFT itself is not the content but a code that signifies ownership, often linking to a URL. Buyers may mistakenly believe they own the associated content, but the original creator retains copyright and the rights to reproduce, distribute, and modify the work.

Moreover, NFTs are not supported by any new legal frameworks at this time. My options for recourse under existing copyright laws would be limited if someone were to misuse my graph.

This raises the question: how is this technology truly "innovative" for creators?

3. Cultural Commodification

Currently, NFTs do not disrupt one of the internet’s fundamental principles: relatively free access to digital assets. Not yet, anyway.

However, their existence is a step toward restricting access, and we should resist this trend. For instance, the iconic video “Charlie Bit My Finger” was sold as an NFT for approximately $800k and subsequently removed from YouTube. The new owner might choose to re-upload it or keep it private.

If we don’t advocate for our shared digital culture, we risk witnessing large portions of the internet becoming exclusive collections, accessible only to a select few.

4. Blending Digital and Real-Life Assets

In addition to digital culture, NFTs can also represent physical assets like homes or vehicles, or even fleeting moments in time. The NBA’s Top Shot is a notable example, selling memorable game clips as GIFs.

While merging digital and physical realms is acceptable to some extent, we must guard against a slippery slope that leads to the monetization of every aspect of life, including MOMENTS IN TIME. That path is fraught with peril.

The technology is undeniably adaptable, allowing almost anything to be sold as an NFT (essentially claiming and selling rights to something). This versatility could be concerning in the long run.

5. Lack of Practical Applications

Let’s face it: we’re not witnessing the advent of the next significant innovation here. It’s been a decade since the first blockchain was introduced, yet no widely used applications exist that rely on this technology. In contrast, when the web was similarly young, it boasted hundreds of millions of users.

So, what do NFTs amount to? Besides potential smart contract applications that have yet to materialize, they primarily serve as flimsy “stores of value” for bored millionaires looking to offload their crypto profits. This value is only sustained as long as market enthusiasm persists, and for anyone paying attention, the hype has already begun to fade.

6. Unsustainable Long-Term Ownership

For an asset to retain its value over time, the storage method must endure. This is feasible for tangible items like artwork or vehicles, but what about NFTs? The average NFT platform might last only a few months or a couple of years. What occurs when these businesses fold, as many start-ups do?

Currently, most platforms selling NFTs lack true innovation and function similarly to random websites selling posters. Once the façade collapses, the promised “store of value” may evaporate, leaving nothing but an error page.

7. Technical Limitations Abound

Even if some companies endure, their infrastructure often relies on outdated internet technologies. A token could disappear if a domain name goes unrenewed.

The reality is that many NFTs do not permanently reside on a blockchain due to energy constraints. The actual content and metadata are stored separately from the smart contract, and that content is not well secured.

Moreover, digital files depend on power for access, and their stability diminishes over time as new systems render them unviewable, often within a year. It would be a miracle if 50% of NFTs survive past 2025.

8. High Costs of Creation and Purchase

Despite claims of democratization, creating an NFT is not inexpensive. You need to "mint" it, which incurs significant costs due to "gas fees." These fees compensate those solving complex cryptographic puzzles, a process that consumes substantial energy and can lead to exorbitant electricity bills.

These costs are often obscured during transactions. They are significant. For instance, I spent $50 to create an NFT for research, pricing it at $1.99, but the gas fees amounted to $100. Ultimately, I receive a mere $0.02, while network operators pocket $150. So much for decentralization.

9. Questionable Decentralization

Much of the NFT marketing hinges on the idea of eliminating intermediaries and facilitating direct interactions between buyers and sellers.

However, guess who facilitated the largest NFT auction a few months back, taking a $6M commission? Christie’s, a centuries-old entity owned by a French billionaire.

Furthermore, the underlying principles of blockchain technologies (Proof of Work and Proof of Stake) disproportionately benefit those with the most influence over them.

Additionally, 70% of the cryptocurrency necessary for NFT purchases is mined in China, painting a less-than-decentralized picture.

10. Environmental Consequences

As previously mentioned, miners must solve complex puzzles to earn rewards, requiring significant processing power and electricity (often derived from coal in places like China). This competitive energy consumption is termed "proof of work," which essentially validates that computational effort has been expended.

This setup rewards those who can consume the most resources, contributing to environmental degradation.

In essence, the cost of an NFT is a mixture of cultural value and the environmental toll of energy consumption.

NFTs are fundamentally flawed. Their underlying concepts lack practical and philosophical coherence, they lack legal support, they fail to deliver on their promises, and their costs are prohibitively high, both economically and environmentally.

The surge in interest for NFTs over the past year can be attributed to a lack of other engaging options. The pandemic spurred a notable rise in NFT attention, unlike when the technology was first introduced in 2017. As the world reopens, many NFT prices have plummeted, and it’s unlikely to be a mere coincidence.

This article was originally crafted for Honeypot.io, a job platform focused on developers in Europe.