Tesla's Upcoming Competition Crisis: Lessons from Netflix

Written on

Chapter 1: The Competition Dilemma

As Tesla prepares to confront challenges akin to those faced by Netflix, competition is becoming increasingly fierce.

This paragraph will result in an indented block of text, typically used for quoting other text.

Section 1.1: Netflix's Journey and Its Current Struggles

Netflix's transition from merely distributing content to producing its own marked a significant risk that ultimately paid off. After the release of "House of Cards" in 2013, the surge in subscriber growth was remarkable. However, this shift alienated some of their suppliers, transforming Netflix from a content distributor into a competitor.

Now, established media giants like Disney and ViacomCBS are withdrawing their content to bolster their own streaming platforms, such as Disney+ and Paramount+. Similarly, Warner Bros Discovery has removed "Friends," one of Netflix's flagship shows, transferring it to HBO Max. As new contenders like Apple and Amazon Prime enter the fray, Netflix finds itself in a multi-front battle.

With subscriber growth stagnating and a reported loss of 200,000 subscribers last quarter, Netflix's challenges are mounting. Although the company attributes its struggles to password sharing, it overlooks the reality that consumers have numerous streaming options and limited budgets. Netflix's binge-watching model, once seen as an innovation, now creates a dilemma: viewers may need to maintain subscriptions to other services to continue watching shows.

The crux of Netflix's issues lies in increased competition. Despite potential for a sustainable business, tech investors prefer monopolies, leading to a decline in Netflix's stock price. Now, let's delve into how Tesla finds itself in a similar predicament.

Section 1.2: Tesla’s Position in the Market

Following a recent decline, Netflix's Price-to-Earnings ratio stands at 17x, while Tesla's ratio soars to a staggering 118x. While investors anticipate Netflix to perform significantly better, they expect Tesla to achieve nearly impossible growth rates.

Tesla's challenge isn't rooted in internal issues but rather in escalating competition.

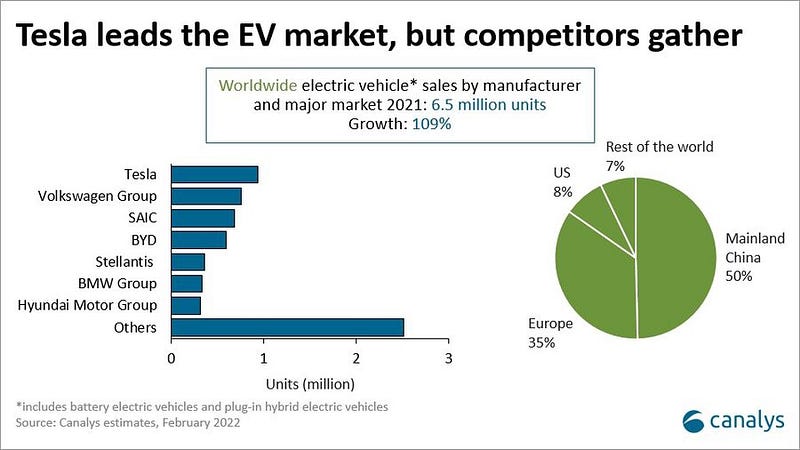

Currently, Tesla leads in sales, but rivals are gaining momentum. The Volkswagen Group, along with Audi and Porsche, is entering the luxury electric vehicle market, while American brands like Ford and GE are producing trucks to cater to their market. Meanwhile, China has emerged as the largest EV market with its own domestic brands.

Tesla's growth trajectory is increasingly threatened as competitors ramp up their efforts.

Subsection 1.2.1: Emerging Competitors

Brands such as BYD, which enjoys robust domestic demand in China, and SAIC, which has acquired Western brands like MG, are expanding their reach in foreign markets. Additionally, Stellantis and GM are formidable players in the U.S. market, and Toyota is finally joining the electric vehicle conversation after focusing on hybrids for too long.

These significant competitors, while not as agile as Tesla, can quickly gain traction and impact the market dynamics. This surge in competition not only raises costs for essential materials but also diverts consumers toward alternative products.

The challenge Tesla faces isn't linked to any singular competitor but rather the competitive landscape as a whole. Unlike streaming services, which can create significant customer loyalty, the automotive sector lacks substantial customer lock-in. While charging infrastructure could provide some advantage, this is a solvable challenge with ample investment.

Like Netflix, Tesla can certainly sustain itself as a business, yet the prospect of achieving extraordinary growth amid fierce competition is unrealistic.

Chapter 2: The Nature of Competition

Competition traditionally drives prices down to subsistence levels for businesses. However, in practice, especially in the automotive industry, various market segments (luxury, work, family) complicate this dynamic. Both Tesla and Netflix have attracted investment based on the assumption that they would capture substantial portions of their respective markets, a scenario that is increasingly improbable.

Streaming services and electric vehicles are too significant to be monopolized by a single entity for long. With no natural monopolies in either sector, competition is inevitable. This reality poses a challenge for companies trading at high earnings multiples. The recent haircut for Netflix serves as a cautionary tale, and for Tesla, a similar reckoning may be on the horizon.

In this video, "How to fix YouTube & Netflix bug in your Tesla (with Rabbit of Caerbannog)," we explore solutions to common streaming issues in Tesla vehicles.

The video "How to watch Netflix in your Tesla (while not in Park) - YouTube" discusses methods for enjoying Netflix while on the move in your Tesla.