# The Surprising Best Hedge for Your Portfolio in 2024

Written on

Chapter 1: Understanding Portfolio Protection

In turbulent times, such as those we've recently faced, investors are primarily focused on one critical question: how can I safeguard my portfolio? The goal is clear—protect against potential losses without sacrificing the opportunity for gains.

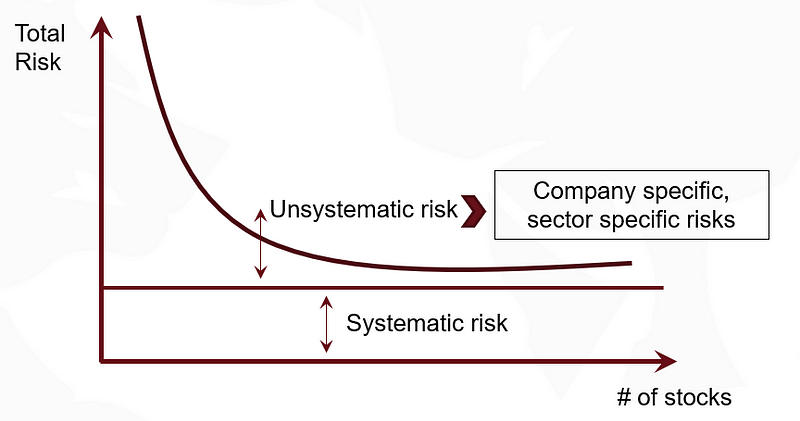

For those relying on traditional asset managers, the typical response is to depend on classic diversification techniques. This approach is effective for mitigating idiosyncratic risks—those specific to individual sectors or companies. By expanding the number of holdings in a portfolio, investors can significantly reduce these firm-specific risks.

However, diversification falls short when confronting systematic risks—such as economic downturns, geopolitical tensions, climate change, and natural disasters. During these challenging times, many are exploring alternative methods for hedging their portfolios.

In this article, I will outline several strategies I employ to hedge my clients' portfolios and unveil the most effective hedge for 2024 so far.

Section 1.1: Traditional Hedging Techniques

One of the most straightforward and widely used hedging strategies involves derivatives, particularly options. These can offer excellent protection against market downturns, similar to the volatility we've encountered recently. While some perceive derivatives as complex and exclusive to professionals, this is a misconception. While the mechanics of options can be intricate, they are accessible and beneficial to any investor willing to learn.

However, a significant drawback of protective put options is their cost, which can range from 1% to 6% of your portfolio annually, depending on market conditions. This expense is notable, especially considering average portfolio returns generally hover around 6% to 10% per year.

In my firm, we implement more innovative approaches to reduce hedging costs. Techniques such as collars, put ratio spreads, and vertical spreads can help make hedging more affordable. If you’re interested in exploring diverse hedging strategies, I invite you to check out my bestselling book available on Amazon.

A Beginner's Guide to Investing and Trading in the Modern Stock Market (Personal Finance and…

A Beginner's Guide to Investing and Trading in the Modern Stock Market (Personal Finance and Investing) - Kindle…

www.amazon.com

Section 1.2: The Unexpected Hedge: Energy

Surprisingly, the most effective hedge for your portfolio this past year has been energy investments—specifically, oil, natural gas, and related companies. The correlation between the XLE ETF, which tracks energy companies, and the SPY ETF, which tracks the S&P 500, has been notably negative at -0.50. This figure indicates a robust hedging potential, with the ideal hedge exhibiting a correlation of -1.0.

We have incorporated the XLE ETF into all our clients' portfolios since the start of the year, and I strongly recommend that others consider doing the same. Given the current climate of war, uncertainty, and increasing demand, our optimistic forecast predicts crude oil prices could exceed $200 per barrel. Therefore, energy is a crucial asset class to contemplate for any portfolio.

Chapter 2: Connecting with the Community

I hope this article has provided valuable insights into enhancing your investment strategy. Feel free to explore more of my work or connect with me to stay informed.

Follow me on Medium!

Check out my books on Amazon!

Become a member on Medium!

Let’s connect on LinkedIn!

Follow me on YouTube for daily market updates!

Follow me on Twitter!

Schedule a DDIChat Session in Hedge Fund and Trading Strategy:

Experts - Hedge Fund and Trading Strategy - DDIChat

DDIChat allows individuals and businesses to speak directly with subject matter experts. It makes consultation fast…

app.ddichat.com

Apply to be a DDIChat Expert here.

Subscribe to DDIntel here.

The first video, "Hedge Your Portfolio Like A Pro," offers insights into effective hedging techniques to protect your investments during market fluctuations.

The second video, "Best Ways to Hedge Long Stock Positions," discusses various strategies for hedging long positions in stocks, ensuring you can safeguard your investments.