Navigating Economic Turbulence: Insights from BlackRock and Burry

Written on

Chapter 1: Understanding Market Shifts

In the realm of U.S. finance, BlackRock stands alongside investment titans like Vanguard, Fidelity, and State Street, often referred to as the "four horsemen" of the economy. As of 2023, BlackRock oversees more than $10 trillion in assets, which constitutes approximately 40% of the United States' GDP. Michael Burry, the hedge fund manager renowned for predicting the 2007–2008 housing crisis, has also gained attention for his insights into the current economic climate. Both BlackRock and Burry have expressed concerns regarding the U.S. economy, and here's what they have to say.

This paragraph will result in an indented block of text, typically used for quoting other text.

Section 1.1: BlackRock's Current Perspective

In a surprising turn, BlackRock's midyear report for 2023 suggests a shift in investment strategy, highlighting slowing growth and persistent inflation in developed markets like the U.S. They now view emerging markets as more appealing investment venues. This shift is significant, akin to a leader expressing a preference for their vacation home over their primary residence.

Three critical insights from the report include:

- Granular Investing: The report indicates that traditional broad asset class strategies may no longer yield satisfactory returns. Investors are encouraged to explore more detailed investment opportunities, moving away from general funds like VT, VTI, or VOO.

- Aging Population: With developed countries experiencing record low birth rates, there is a potential for prolonged inflation and a rising demand for sectors focused on senior care, such as healthcare, real estate, and leisure activities.

- Global Fragmentation: According to BlackRock, geopolitical tensions, such as the Ukraine conflict and deteriorating U.S.-China relations, have ushered in a new era marked by economic fragmentation, leading to increased volatility in global economic growth while opening doors in emerging markets.

As September approaches, historically a challenging month for stock markets, it remains to be seen if this will mark the beginning of a downturn.

Section 1.2: Michael Burry's Alarm

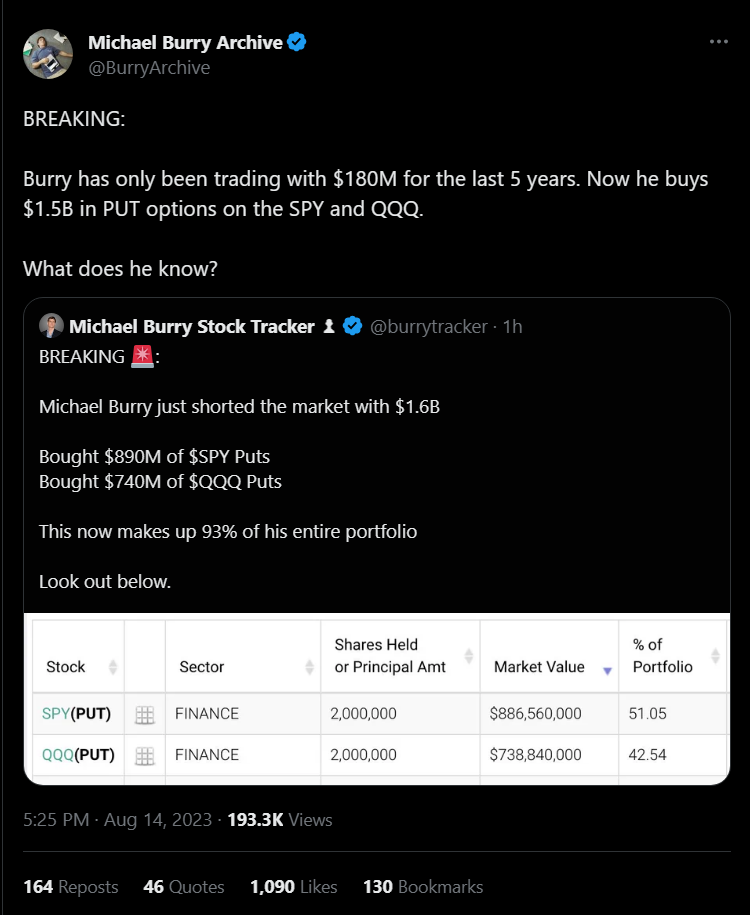

Michael Burry's recent investment strategy includes purchasing $1.6 billion worth of stock market puts, indicating his strong belief that the U.S. economy is on the brink of a significant downturn similar to the one seen in 2008. His track record includes not only the housing market crash but also predictions regarding the Dotcom bubble, GameStop's rise, and shorts on Cathie Wood’s tech-heavy ARKK funds.

The current stock market appears robust; however, Burry and I share a concern that this illusion contrasts starkly with the actual economic situation. We are witnessing a continuation of the unrealistic optimism that characterized the COVID-19 market era, where participants cling to the hope of a painless recovery.

As of 2023, the reality has worsened, with indicators like student loan debt soaring to $2 trillion and credit card debt climbing by an astounding $45 billion in just three months, reaching a new peak of $1 trillion. Furthermore, the 10-year treasury yield recently hit its highest point since November 2007, signaling a lack of confidence in both government debt and a quick economic recovery.

Chapter 2: Preparing for the Unknown

In the video titled "What Happened to Michael Burry's Stock Market Predictions?" we delve into Burry's insights and what they mean for future investments.

The second video, "Michael Burry's New Warning for the 2023 Recession," discusses his latest concerns regarding the economy and potential market downturns.

As I previously warned at the start of 2023, I foresee September marking a critical point in the economic landscape — one that could lead to an unprecedented crash. The signs are dire, and the atmosphere is heavy with foreboding.

Yet, it's essential to maintain perspective. Although indicators point to a potential downturn, it's crucial to remain composed. The internet culture often amplifies negativity, leading to a collective anxiety that can overshadow rational thinking.

Final Thoughts

So, what is my strategy amidst this uncertainty? I’m refraining from new purchases and liquidating some assets to ensure I have adequate funds should an unexpected crisis arise. However, I refuse to succumb to panic. Instead, I aim to embody the prudent approaches of BlackRock and Michael Burry: stay prepared but avoid hysteria.

Stay grounded, hold onto long-term investments with solid fundamentals, and only sell assets when necessary. Trust that, in time, circumstances will improve. Step outside, disconnect from the online chaos, and remember to breathe.

Join over 4,000 individuals on my Substack for access to my new eBook "Gold2.0." While I have always aspired to be a financial advisor, I must remind you that I am not one. Conduct your own research and approach investment decisions with caution. This publication does not constitute financial advice.